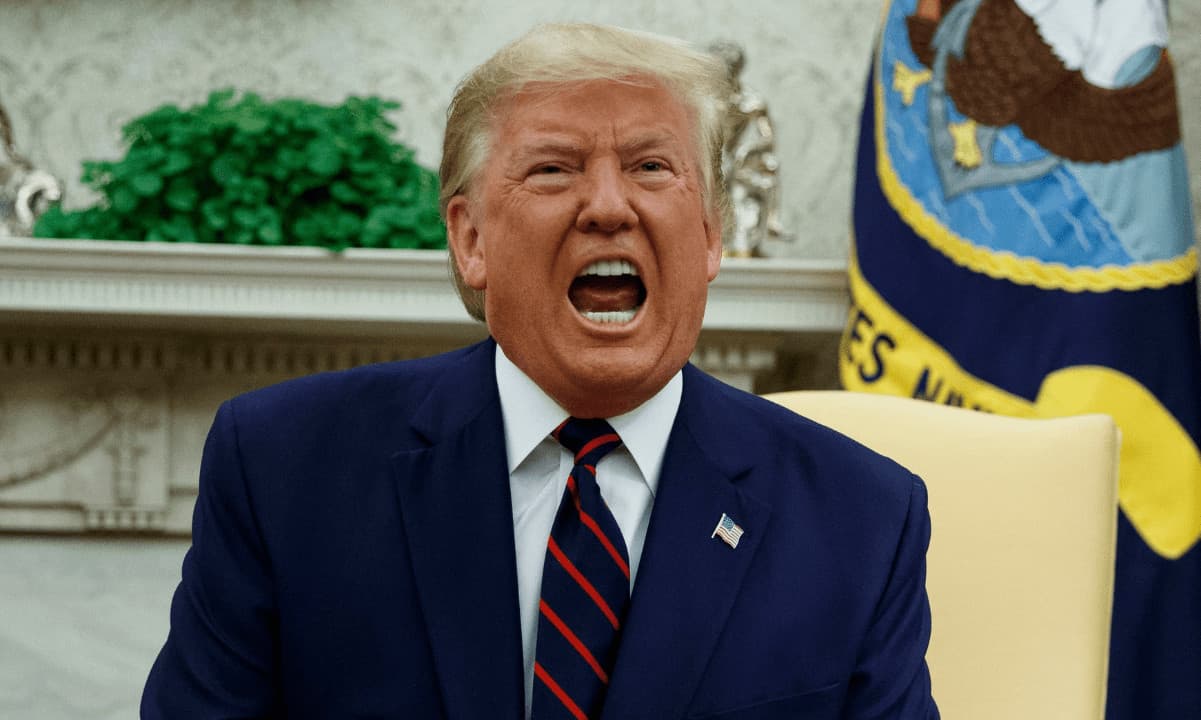

Will Trump’s ‘Quick-Time period Ache’ Plan Lead to Lengthy-Time period Positive factors for Crypto?

Excessive-risk belongings corresponding to tech shares and crypto have been promoting off closely over the previous month or in order Donald Trump’s commerce warfare escalates.

Nonetheless, this might all be a part of a “quick time period ache” masterplan in a technique that goals to decrease inflation and refinance round $9 trillion of US debt by permitting market weak point, reported the Kobeissi Letter.

“We now have seen over $5 trillion erased from US shares with the aim of decreasing charges. Will it work?”

Deliberate Market Turmoil

The administration seems unified on this method, with Commerce Secretary Howard Lutnick stating, “Inventory market not driving outcomes for this admin,” Treasury Secretary Scott Bessent saying he’s “Not involved about just a little volatility,” and Trump acknowledging a “interval of transition” that can “take some time.”

Elon Musk additionally seems to assist this technique, saying Tesla inventory “might be nice long-term” regardless of TSLA tanking 40% because the starting of this 12 months.

It’s very clear what’s taking place:

President Trump now believes “quick time period ache” is his ONLY choice to decrease inflation and refinance $9+ trillion of US debt.

We now have seen over -$5 TRILLION erased from US shares with the aim of LOWERING charges.

Will it work?

(a thread) pic.twitter.com/QlQYU65AZT

— The Kobeissi Letter (@KobeissiLetter) March 13, 2025

This intentional tanking of markets could also be pushed by a number of elements, corresponding to a document authorities deficit reaching $1.15 trillion in February, a want to decrease oil costs, plans to cut back the US commerce deficit by means of tariffs, and a aim to chop authorities jobs which have accounted for latest job development.

Trump’s financial weak point plans seem to have a number of targets, together with decreasing inflation (at present 2.8%), oil costs, and rates of interest. He additionally goals to cut back deficit spending, commerce deficits, and authorities inefficiency.

Economist Joe Foudy told Newsweek that it is a “political recognition” earlier than including:

“If the inventory market responds negatively or if we see weaker financial information, Trump must get forward of the narrative. By framing short-term financial downturns as needed for long-term positive aspects, he’s managing expectations.”

“Usually, the Federal Reserve would decrease rates of interest to stabilize the economic system. But when tariffs drive up costs, policymakers might hesitate, fearing charge cuts may gasoline inflation,” commented NYU economics professor Lawrence White.

Trump is clearly telling his plans.

He doesn’t care concerning the inventory market or the crypto market.

All he cares about is that rates of interest to go down which will certainly trigger some short-term ache.

This jogs my memory of This autumn 2021 when Powell was calling for larger charges and… pic.twitter.com/b6SRvNwRf8

— Cas Abbé (@cas_abbe) March 13, 2025

Impacts on Crypto Markets

This “short-term ache” method may result in important market volatility throughout all asset courses, together with cryptocurrencies. As conventional markets expertise downturns, traders might cut back publicity to high-risk belongings like crypto to cowl losses elsewhere or transfer to money positions, extra so if rates of interest enhance once more.

Market instability may additionally result in liquidity points in crypto markets, probably inflicting exaggerated value actions. Crypto may proceed following inventory market traits within the quick time period. The market has already declined by round 25% over the previous couple of months as $1 trillion has left the area.

In the long run, decreasing rates of interest may ultimately profit it instead funding when low cost cash seems to be for yields.

Furthermore, financial instability may speed up crypto regulation efforts, which may provide clarity and probably appeal to extra institutional adoption.

If the technique impacts greenback energy, which has weakened recently, cryptocurrencies may gain advantage as options to fiat currencies.

Over time, crypto markets may steadily decouple from conventional markets because the sector matures and establishes its personal financial cycles, nevertheless there’s more likely to be extra ache earlier than any positive aspects.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome supply on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!